Central Pennsylvania regional M&A update: Q2 2019

M&A activity

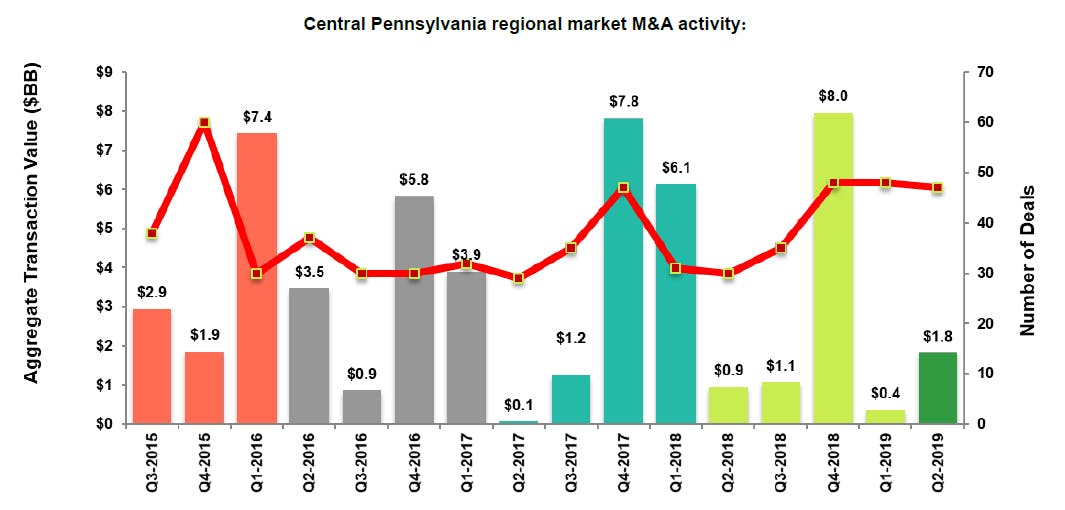

There were 47 transactions that closed in the central Pennsylvania regional market during the second quarter of 2019 (Q2 2019), a slight decrease from the 48 closed transactions in the prior quarter. The 47 closed transactions marked a large increase of 56.7 percent from the 30 closed transactions during the same period in 2018.

Following a strong 2018, North America’s overall Q2 2019 M&A activity has remained fervent. Median deal size in North America rose to $93.5 million through Q2 2019, a dramatic increase from $57.0 million in 2018. The sustained stock market boom amidst a historically borrower-friendly lending environment has spurred this rise in deal size, with the $19.7 billion merger between Harris Corporation and L3 Technologies and the $11.0 billion take-private of Ultimate Software Group representing the largest transactions. Sponsor-backed transactions continue to increase as such transactions accounted for 39.4 percent of transactions through Q2 2019, up from 36.3 percent in 2018.

With slowing organic growth and increasing fear of a market downturn, large companies are insulating themselves from potential adverse effects of a changing economic landscape through M&A to shore up profit margins and increase market share. Because of active M&A markets, valuations continue to climb. The median valuation / EBITDA multiple for M&A transactions rose slightly to 10.2x through Q2 2019, up from 9.4x in 2018.

M&A activity by industry

The consumer sector led the central Pennsylvania region’s M&A activity with 34.0 percent of the total deals closed in Q2 2019. The industrials sector accounted for the second largest percentage of the total deals closed, with 19.1 percent. The healthcare sector represented the next most deals, with 17.0 percent of the closed deals for the period, followed by the information technology sector, which accounted for 12.8 percent of closed deals in the quarter. The financials and materials sectors each accounted for 6.4 percent of closed deals, and the telecom sector rounded out the M&A activity in central Pennsylvania for Q2 2019 with 4.3 percent of closed deals.

Read the full update

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.

Source: S&P Capital IQ, PitchBook and Baker Tilly Capital research (July 2019)