U.S. companies with current business and operations in Canada and Mexico made the decision to do so based on the advantages that the North American Free Trade Agreement (NAFTA) offered. Many have made significant investments associated with those decisions based on the trade environment created by those rules. Modifications made and enforced by the U.S.-Mexico-Canada Agreement (USMCA) will inevitably affect the business value of those decisions.

What’s changing

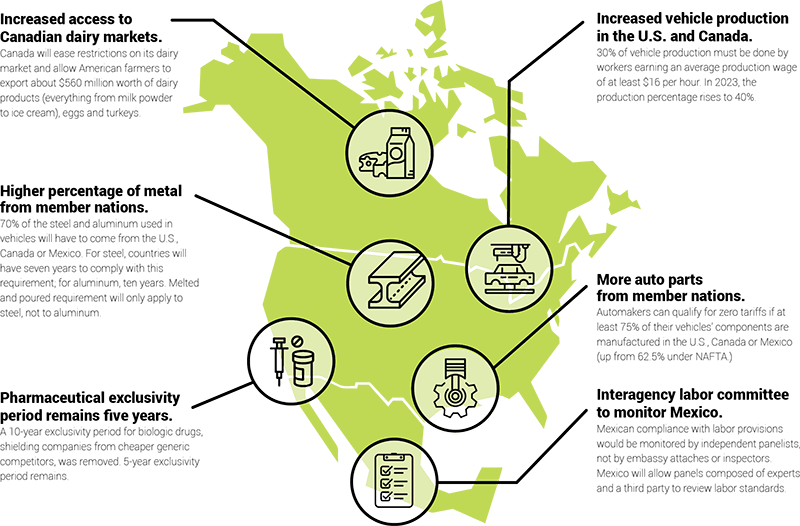

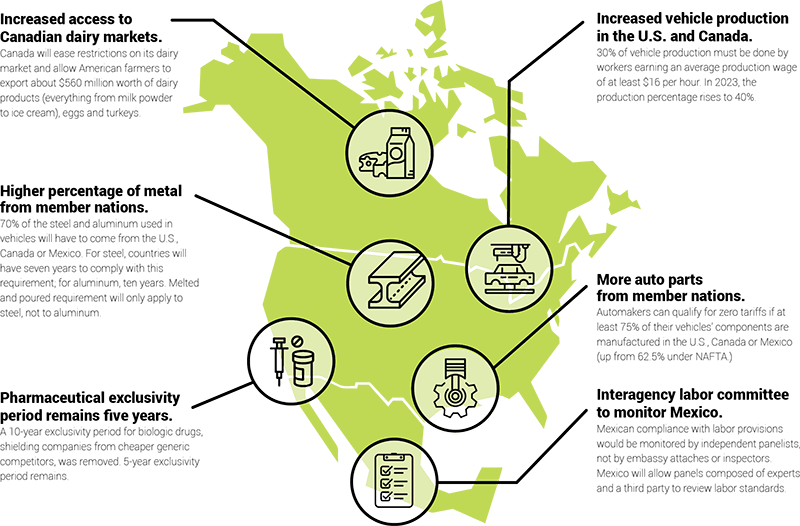

Increased vehicle production in the U.S. and Canada. 30% of vehicle production must be done by workers earning an average production wage of at least $16 per hour. In 2023, the production percentage rises to 40%.

More auto parts from member nations. Automakers can qualify for zero tariffs if at least 75% of their vehicles’ components are manufactured in the U.S., Canada or Mexico (up from 62.5% under NAFTA).

Higher percentage of metal from member nations. 70% of the steel and aluminum used in vehicles will have to come from the U.S., Canada or Mexico. For steel, countries will have seven years to comply with this requirement; for aluminum, ten years. Melted and poured requirement will only apply to steel, not to aluminum.

Interagency labor committee to monitor Mexico. Mexican compliance with labor provisions would be monitored by independent panelists, not by embassy attaches or inspectors. Mexico will allow panels composed of experts and a third party to review labor standards.

Pharmaceutical exclusivity period remains five years. A 10-year exclusivity period for biologic drugs, shielding companies from cheaper generic competitors, was removed. 5-year exclusivity period remains.

Increased access to Canadian dairy markets. Canada will ease restrictions on its dairy market and allow American farmers to export about $560 million worth of dairy products (everything from milk powder to ice cream), eggs and turkeys.