What construction companies need to know about the new lease standard: five key takeaways

While the new lease standard, ASC 842, is already making a major impact on construction companies, many construction leaders still do not understand the key concepts of the standard, not to mention the complexities of the process or where to find professional assistance with their implementation.

With this in mind, we recently led a comprehensive webinar that provided an overview of ASC 842 as it applies to construction companies. We highlighted the important concepts and challenges, outlined the implementation process and detailed how Baker Tilly can assist construction companies with their ASC 842 needs.

Below are five key takeaways from that webinar, “What construction companies need to know about the new lease standard,” which you can view here.

1. Not prepared? You’re not alone

Our first takeaway comes from two of the polling questions from the webinar. The first asked simply whether the participants’ construction companies have started ASC 842 adoption. The results were basically a 50/50 split between the nearly 200 respondents.

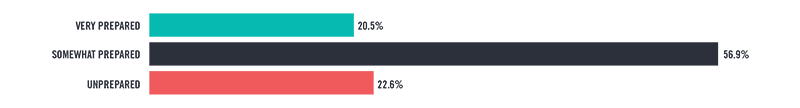

Later in the presentation, we asked the viewers what their construction companies’ level of preparedness was for ASC 842. There were three options: Very prepared, somewhat prepared and unprepared. And among all the participants, 79.5% categorized their companies as somewhat prepared or unprepared. Just 1 in 5 felt chose “very prepared.”

These results aligned with our expectations based on many discussions with clients and other construction professionals – that many companies have not even begun the process, and that the level of preparedness across the industry is not where it needs to be.

2. Changes in disclosures

One of the areas of ASC 842 that often gets overlooked is the disclosures. With ASC 840, the required financial statement disclosures generally were just the five-year commitment stable showing your future minimum lease payments. With ASC 842, that is no longer the case. In this standard, disclosure requirements have been greatly enhanced – both quantitively and qualitatively.

Some of the new qualitative disclosures include:

- General description

- Basis and terms and conditions of variable lease payments

- Existence and terms and conditions about the options to extend or terminate the lease

- Existence and terms and conditions of residual value guarantees

- Allocation of consideration between lease and non-lease components

- Determination of discount rate

- Accounting policy elections

- Practical expedients

- Information about leases not yet commenced, but that create significant rights and obligations

- Main terms and conditions of any sale-leaseback transactions

Quantitative disclosures required by ASC 842 include some new requirements for lessees while retaining many previously required disclosures. One of the more significant is weighted-average disclosures on discount rates and the lease terms that are used.

3. Tracking leases

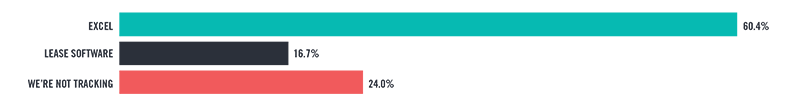

There are two primary methods for tracking leases: an Excel-based tracker and lease-specific software. One of the polling questions in the webinar asked the participants how their construction company is tracking leases currently. The results were as follows:

Baker Tilly uses Visual Lease, but there are dozens of leasing software available. With that in mind, we generally recommend that companies use a leasing software if they have 10 or more leases to track.

Some of the benefits of lease accounting software include:

Accurate lease entries

- Classification

- Modifications

- Automated amortization schedules and journal entries

- Variable lease payments

Ease of financial statement preparation and disclosures

- Aggregating leases

- Weighted-average discount rate and remaining lease term

Improvement in budgeting, forecasting and financial decisions

Monitoring of critical dates and/or lease renewal dates

Document management

4. The biggest challenges

The top recurring challenge in ASC 842 implementation is generally the incompleteness or inaccuracy of lease data. A large source of the problem is that companies don’t typically compile a full list of leases until they get pretty far down the path of information gathering. And leases can come in various forms – they can be entire contracts, or they can be buried within larger contracts – so it is fairly easy to miss some of them.

In an effort to combat this challenge, we recommend starting with the existing information you have – commitments schedules, deferred rents schedules under ASC 840, trial balances/sub-ledger details, etc. And of course, think about where else there could be leases within the company, which includes talking to people in various departments, taking a comprehensive look at the available data and examining your vendors’ spending trends.

Other challenges that we see frequently include:

- Company capabilities and capacity: Ensure the right resources, both inside and outside the company, are involved in the process, early and often. This includes internal people such as those in accounting, real estate, tax, etc., and outside vendors such as software providers and technical accounting specialists. You want to make sure everyone is trained on the requirements of ASC 842 before you get too far into the process.

- Accounting policy elections: This includes identifying practical expedients and considering how companies choose to account for lease and non-lease components within leases. But the main thing is making sure these factors have been thoroughly considered and practically applied and disclosed. These elements also need to be communicated thoroughly early on to eliminate any surprises later in the process.

- Day 2 accounting: When it comes to changes in leases (lease modifications, new leases), you need to make sure there is a process in place to account for those in a timely fashion. There needs to be consistency within the policies to allow for streamlined integration of new leases.

5. How Baker Tilly can help

Baker Tilly has a full team of lease accounting specialists who can assist with everything from small technical questions and minor consultations to a full end-to-end ASC 842 outsourcing model. Below is an overview of the areas in which Baker Tilly regularly assists construction clients with their ASC 842 implementations.

Project oversight/technical accounting

- Project management

- Implementation plan

- Employee training

- Policies and procedures

- Adoption technical memos

Adoption impact

- Lease identification and inventory

- Lease portfolio analysis

- Embedded lease analysis

- Readiness risk assessment

Lease administration software

- Lease software evaluation and selection

- Lease software implementation

- Introduction to lease tool software providers

Financial reporting

- Incremental Borrowing Rate determination support

- Lease abstraction

- Transition and post-adoption journal entries

- Footnote disclosures

Post-adoption

- Financial statement impact assessment

- Outsourced lease administration

- Lease structuring advisory

To learn more about the ways ASC 842 can impact construction companies, you can watch our ASC 842 webinar. And to discuss how Baker Tilly can assist your company with ASC 842, feel free to contact us.